Orkim Bhd also introduced a dividend policy of distributing between 50 per cent and 70 per cent of net profit.

KUALA LUMPUR: Malaysia's leading tanker operator, Orkim Bhd, has launched its initial public offering (IPO) prospectus ahead of its debut on Bursa Malaysia's Main Market on Dec 9, 2025, marking a pivotal step in the group's next phase of expansion.

The IPO consists of an offer for sale of 300 million existing shares and a public issue of 100 million new shares at 92 sen each. The public issue is expected to raise RM92 million in gross proceeds, of which a substantial 87 per cent will be channelled into acquiring new vessels, including chemical and petroleum product tankers. The balance will be allocated to working capital and listing-related expenses.

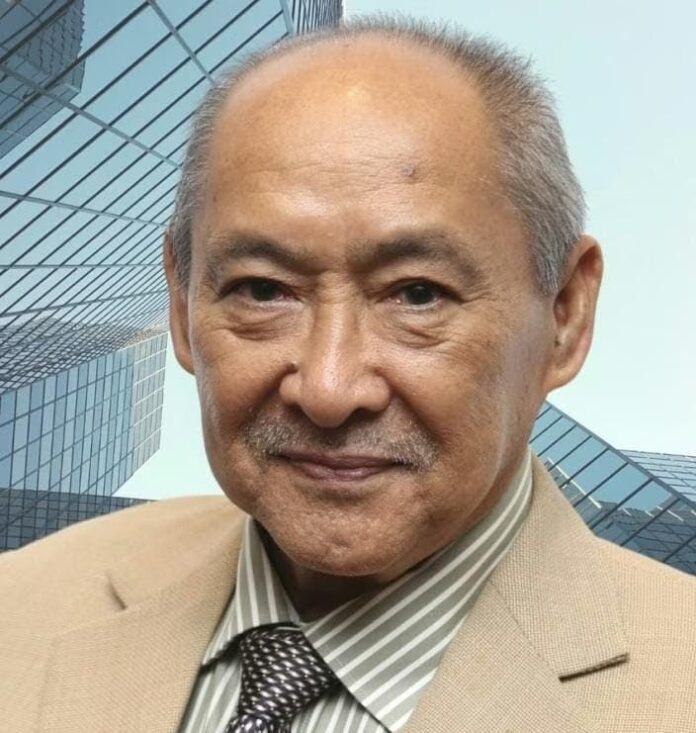

Executive director and chief executive officer Captain Cheah Sin Bi said at the prospectus launch today that the listing marks how far Orkim has progressed since its modest beginnings 17 years ago.

"When we started in 2007, Orkim was a small company with big dreams. We began with shipbroking and ship management services, operating third-party vessels. A year later, we acquired our first tanker, Orkim Power, and that became the vessel that carried our aspirations forward. We see our role as part of something larger, as a builder of Malaysia's maritime ecosystem.

"We support the nation's fuel and energy security with the provision of vital marine logistics, ensuring continuity and reliability in supply chains that keep Malaysia moving. We also develop and train Malaysian seafarers, including women, creating opportunities for local talent to grow within the maritime sector."

Orkim currently operates a modern fleet of 18 vessels with a combined capacity of 239,186 deadweight tonnes (DWT). This includes 14 clean petroleum product (CPP) tankers totalling 134,684 DWT, two medium-range CPP tankers at 98,004 DWT, and two LPG tankers with 6,498 DWT.

According to an independent market study, Orkim's 15-strong CPP tanker fleet gives it a commanding 56 per cent share of Malaysia's chemical and petroleum tanker segment – cementing its leadership position among domestic operators and its strong presence across regional markets, including Singapore, the Philippines, Brunei, China, and South Korea.

"This underscores our position as the leading domestic operator, serving reputable domestic and regional oil majors. From a small local player, we have become a trusted regional partner," Cheah said, adding that the group's reputation has been built on safe, consistent and on-time service delivery.

"As we look ahead, Orkim's next phase of growth is already underway. The recent addition of our largest tanker, Orkim Citrine, marks another milestone in our fleet rejuvenation and expansion journey.

Since 2022, Orkim's annual revenue has consistently surpassed RM300 million, while net profit climbed to RM92.9 million in 2024, up from RM81 million the previous year.

As of August 2025, the company's time charter contracts carried an outstanding value of RM633.9 million - including extension periods - providing earnings visibility through 2032, according to MARC Ratings Bhd.

He noted that Orkim's expansion is already accelerating, with the recent addition of its largest vessel, Orkim Citrine, and two new tankers under construction for 2027 delivery.

"We are strengthening our fleet with two new vessels under construction for delivery in 2027, while modernising to meet the highest ESG and HSSE standards. At the same time, we continue to invest in digitalisation to enhance efficiency, reduce emissions, and align with the International Marine Organisation's 2030 goals."

Cheah also thanked Ekuiti Nasional Bhd for its longstanding support as an investor and strategic partner.

Meanwhile, Orkim's chairman Datuk Abdul Hamid Sh Mohamed said RM80 million of the IPO proceeds will be used for fleet expansion and rejuvenation, reinforcing long-term growth and competitiveness.

"As we chart this next course, we remain deeply committed to creating sustainable long-term value for our shareholders," he said.

The group has also introduced a dividend policy of distributing between 50 per cent and 70 per cent of net profit…

Continue reading the full story at the original source: