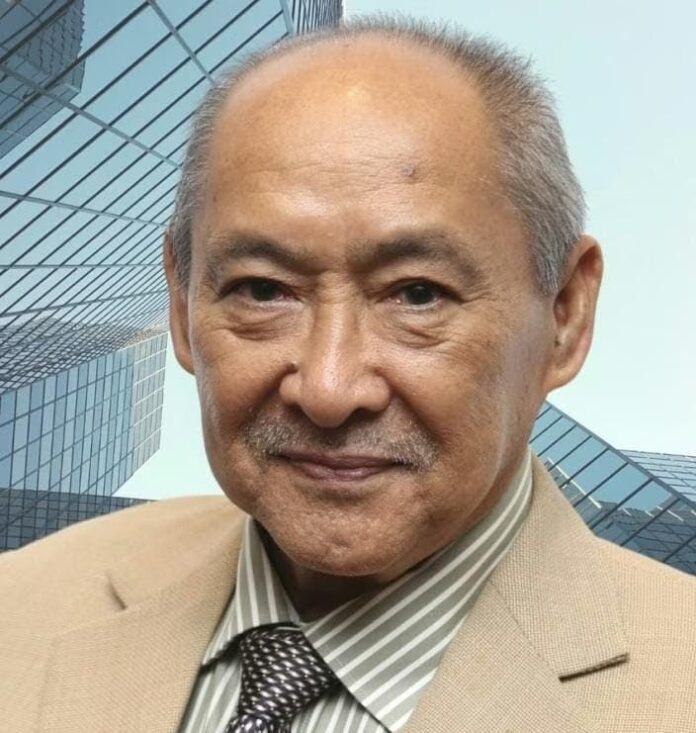

Finance Minister II Datuk Seri Amir Hamzah Azizan (Photos by Shahrill Basri/The Edge)

KUALA LUMPUR (Dec 9): The government is discussing the extension of the income tax exemption for the marine transportation industry beyond 2026, said Finance Minister II Datuk Seri Amir Hamzah Azizan.

Amir Hamzah said the government recognises that Malaysia is a maritime nation and that long-term competitiveness requires a strong base of local vessel operators. Talks are ongoing between the Transport Ministry and Finance Ministry to support the system, he said on Tuesday (Dec 9).

“And if tax incentives are required, we will continue to support [them] through tax incentives along the way,” he told reporters after the listing ceremony of shipping firm Orkim Bhd.

Amir Hamzah was responding to questions about the incentive disclosed by the company in its listing prospectus.

Orkim currently benefits from the Income Tax (Exemption for Malaysian Ship) Order 2024, gazetted on July 5, 2024. The order grants 100% income tax exemption on statutory income from transporting passengers or cargo by sea on Malaysian-flagged ships, or from chartering such vessels on a voyage or time charter basis.

The exemption applies for Years of Assessment 2024 to 2026, subject to compliance conditions, including minimum annual operating expenditure per vessel and adequate full-time shore employees.

Orkim is hopeful that the incentive will be renewed again, said its chairman Datuk Abdul Hamid Sheikh Mohamed at the press conference on Tuesday…

Continue reading the full story at the original source: