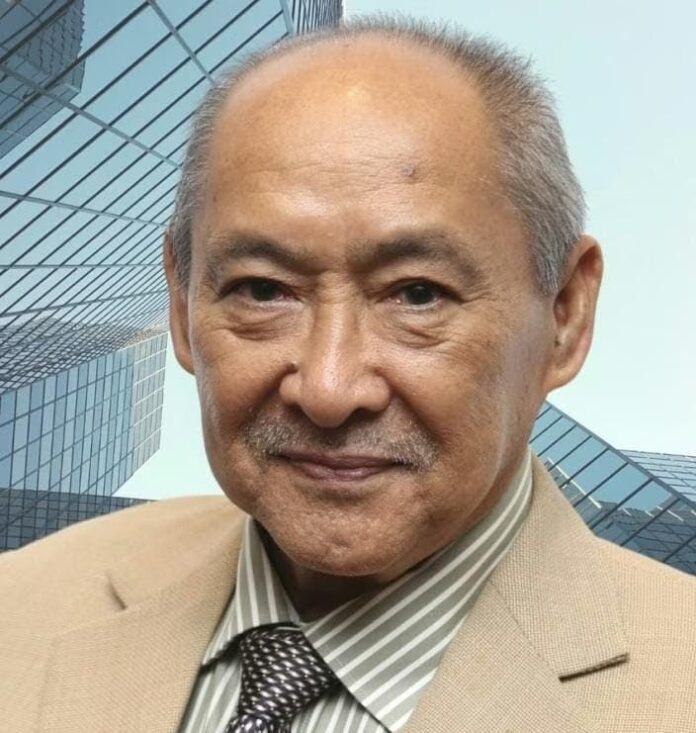

Ketua Orkim Bhd berkata Pelan Induk Maritim Malaysia 2026–2040 selari dengan trajektori pertumbuhannya sendiri. Kredit gambar: Orkim

KUALA LUMPUR: MALAYSIA sedang merancang laluan baru yang berani untuk masa depan maritimnya, berlandaskan Pelan Induk Maritim Malaysia 2026–2040, satu strategi jangka panjang untuk menghidupkan semula industri perkapalan, menaiktaraf infrastruktur pelabuhan, dan membongkar potensi penuh ekonomi biru negara.

Di bawah pelan transformasi ini, industri bekalan bahan bakar marin dijangka melonjak kepada RM19.4 bilion menjelang 2030, dipacu oleh gelombang baru menaiktaraf dok kapal, pengembangan pelabuhan, dan penciptaan hab ekonomi biru khusus di seluruh negeri pantai utama, termasuk Sabah, Terengganu, Perak, dan Kelantan.

Ahli ekonomi dan penganalisis industri percaya bahawa masa pelan induk ini tidak mungkin lebih baik. Ketika rantaian bekalan global mengalami penyusunan semula dan laluan perkapalan beralih sebagai respons terhadap perubahan geopolitik dan ekonomi, aset maritim Malaysia semakin mendapat kepentingan strategik yang baru.

Menurut Persatuan Perkapalan Malaysia (SAM), kedudukan strategik negara di sepanjang Selat Melaka – salah satu koridor perdagangan paling sibuk di dunia – ditambah dengan kos tenaga yang kompetitif, ekosistem logistik yang kukuh, dan pelabuhan yang mantap, memberikan Malaysia asas yang kukuh untuk meraih bahagian yang lebih besar dalam perdagangan maritim serantau.

Seorang pakar industri menyatakan bahawa strategi maritim ini seiring rapat dengan Rancangan Malaysia Ke-13 (13MP), yang menekankan penyeimbangan semula serantau, hubungan infrastruktur, dan pemodenan industri.

"Pelan induk ini bukan sekadar tentang memperkukuh keupayaan maritim Malaysia. Ini tentang mendorong pertumbuhan yang seimbang dan inklusif di seluruh kawasan pantai dan meletakkan Malaysia sebagai pemain utama dalam rantaian nilai maritim global," kata pakar tersebut.

Untuk Orkim Bhd, salah satu pengendali kapal tangki terkemuka Malaysia, agenda maritim nasional ini sejalan dengan trajektori pertumbuhannya sendiri.

Ketua Pegawai Eksekutif Kapt. Cheah Sin Bi berkata ketika Malaysia bergerak ke hadapan di bawah pelan induk baru ini, kisah pertumbuhan Orkim adalah bukti bagaimana cita-cita nasional dan tujuan korporat dapat bergerak seiring, mendorong kedua-dua syarikat dan negara menuju masa depan maritim yang lebih dinamik, mampan, dan berdaya saing di peringkat global.

Kisahnya mencerminkan evolusi sektor maritim Malaysia. "Dari sebuah kapal tunggal pada tahun 2009 kepada 18 kapal dalam armada semasanya, perjalanan Orkim mencerminkan kemajuan maritim Malaysia yang lebih luas – stabil, strategik, dan berlandaskan tujuan."

Belayar Menuju IPO dan Pertumbuhan

Setelah 17 tahun pertumbuhan yang konsisten, syarikat yang dimiliki sepenuhnya oleh Bumiputera ini, yang disokong oleh firma ekuiti swasta yang disambungkan kepada kerajaan, Ekuiti Nasional Bhd (Ekuinas), kini bersiap sedia untuk pencapaian utama seterusnya – kemunculan di Pasaran Utama Bursa Malaysia, selepas pengajuan permohonan penawaran awam permulaan (IPO) pada bulan Julai tahun ini.

"Kami telah mengemukakan permohonan kami kepada Suruhanjaya Sekuriti dan melantik penasihat kami. IPO bukan sekadar tentang pengumpulan dana; ia tentang ketelusan, pertumbuhan, dan mengukuhkan keyakinan dalam industri maritim Malaysia," kata Kapt. Cheah kepada Business Times.

Antara 2025 dan 2027, Orkim merancang untuk menambah lima kapal tangki tambahan dalam armadanya: satu tanker kimia jarak sederhana (MR) terpakai telah diperoleh pada bulan Oktober 2025, dan empat kapal tangki produk petroleum bersih (CPP) dan kimia, dua daripadanya sudah dalam pembinaan dan dijangka siap pada tahun 2027. Pengembangan armada akan dibiayai melalui gabungan hasil IPO, pinjaman, dan dana dalaman.

"Kami telah membelanjakan sekitar RM1 bilion dalam perbelanjaan modal sejak 2009, dibiayai melalui pelbagai sumber, termasuk pinjaman komersial dan sukuk terkini kami. Pelaburan masa depan akan bergantung kepada, antara lain, saiz dan jenis kapal," katanya.

Kapt. Cheah memimpin usaha pembaharuan armada dan digitalisasi, memperkenalkan sistem penjejakan masa nyata dan berasaskan data yang meningkatkan kecekapan, keselamatan, dan pematuhan, membantu Orkim mengekalkan sekitar 90 peratus penggunaan dari 2022 hingga 2024 walaupun menghadapi cabaran pasca-pandemik.

Menurut statistik terkini yang tersedia pada tahun 2024, dengan 14 kapal CPP yang menjumlahkan 134,684 tan deadweight (DWT) dan satu kapal tangki jarak sederhana dengan 48,005 DWT, Orkim mengawal 56 peratus bahagian pasaran dari 27 tanker kimia dan petroleum berdaftar di Malaysia. Syarikat juga memiliki dua kapal tangki gas petroleum cecair (LPG) dengan kapasiti keseluruhan 6,498 DWT, menjadikannya pemilik dan pengendali kapal LPG Malaysia, sambungan penting dalam rantaian bekalan tenaga negara.

Senarai pelanggan Orkim termasuk PETRONAS, BHP, dan Petron, dengan operasi merentangi setiap pelabuhan utama Malaysia – dari Langkawi ke Port Klang – serta laluan antarabangsa melalui Singapura, Filipina, Brunei, China, dan Korea Selatan.

Merancang Lautan Stabil

Bab seterusnya untuk Orkim ditentukan oleh kepimpinan yang disiplin, inovasi, dan transformasi strategik di bawah pimpinan Captain Cheah. Sejak mengambil alih peranan pada tahun 2021, dia telah memacu evolusi syarikat menjadi pengendali yang moden dan berasaskan teknologi dengan kehadiran serantau yang semakin berkembang dan komitmen yang teguh terhadap kelestarian.

Seorang pelaut berpengalaman yang beralih menjadi strategis, Kapt. Cheah telah mengubah Orkim dari pemain tempatan yang sederhana menjadi sebuah perusahaan maritim yang diiktiraf di peringkat serantau di tengah-tengah jaringan logistik tenaga Malaysia.

Perjalanannya dalam maritim bermula pada tahun 2000 sebagai pegawai kadet di bawah program penajaan Global Maritime Ventures Bhd. Didorong oleh cita-cita dan ketekunan, dia telah naik pangkat untuk menjadi salah satu kapten kapal termuda Malaysia dalam segmen tanker kimia. Setelah lebih dari satu dekad di laut, dia mendarat dan menyertai Orkim pada tahun 2011, maju melalui jawatan kepimpinan utama - dari superintendan marin kepada CEO pada tahun 2018.

Di bawah pimpinannya, Orkim telah mengukuhkan kedudukannya dalam sektor pengangkutan CPP dan LPG, memantapkan peranannya sebagai pemain kritikal dalam ekosistem logistik tenaga Malaysia.

"Operasi maritim hari ini memerlukan ketepatan, bukan sekadar kemahiran pelaut," kata Kapt. Cheah, yang memegang ijazah sarjana muda dalam teknologi pengurusan (pengangkutan maritim) dan Sijil Kemahiran Kelas 1 sebagai kapten (pelayaran tanpa had) yang dikeluarkan oleh Jabatan Maritim Malaysia.

Untuk rakyat Malaysia yang bercita-cita, dia mempunyai mesej yang jelas: "Industri perkapalan adalah tulang belakang ekonomi Malaysia. Ia memberi ganjaran dan jauh lebih pelbagai daripada yang difikirkan orang - dari logistik dan operasi pelabuhan kepada pengurusan kapal. Kami memerlukan lebih ramai rakyat Malaysia, terutama wanita, untuk memacu industri ini ke hadapan."

Walaupun menghadapi ketidaktentuan harga minyak global, Orkim telah mengekalkan perjalanan yang stabil, berlandaskan model perniagaan jangka panjang yang berasaskan penyewaan yang memastikan pendapatan yang stabil dan boleh dijangka.

"Kontrak kami biasanya berlangsung antara satu hingga sepuluh tahun. Itu memberi kami kedua-dua kestabilan dan kebolehjangkaan," kata Kapt. Cheah.

Sejak 2022, hasil tahunan Orkim secara konsisten melebihi RM300 juta, manakala keuntungan bersih meningkat kepada RM92.9 juta pada tahun 2024, naik daripada RM81 juta pada tahun sebelumnya.

Sehingga Ogos 2025, nilai kontrak penyewaan masa syarikat mencapai RM633.9 juta - termasuk tempoh lanjutan - memberikan gambaran pendapatan yang jelas sehingga 2032, menurut MARC Ratings Bhd.

Menunjukkan asas-asas yang kukuh, MARC baru-baru ini mengesahkan penarafan AA-IS Orkim untuk program Nota Jangka Pertengahan Islam RM1 bilion dan mengubah pandangannya kepada positif, menandakan keyakinan yang semakin meningkat terhadap prestasi jangka panjang dan tadbir urus syarikat.

Agensi penarafan itu mengharapkan pendapatan Orkim akan mengukuh dari 2026 dan seterusnya, disokong oleh sumbangan daripada tanker MR yang baru diperoleh dan pengoperasian dua kapal baru pada tahun 2027, kedua-duanya diikat di bawah penyewaan jangka panjang dengan syarikat minyak utama.

Pandangan positif ini juga mencerminkan keyakinan terhadap IPO yang dicadangkan oleh Orkim, yang akan menyaksikan Permodalan Nasional Bhd (PNB) dan Dana Amanah di bawah pengurusannya (secara kolektif, Kumpulan PNB) muncul sebagai pemegang saham majoriti.

Teruskan pembacaan cerita penuh di sumber asal: